Sketch is where

great design happens.

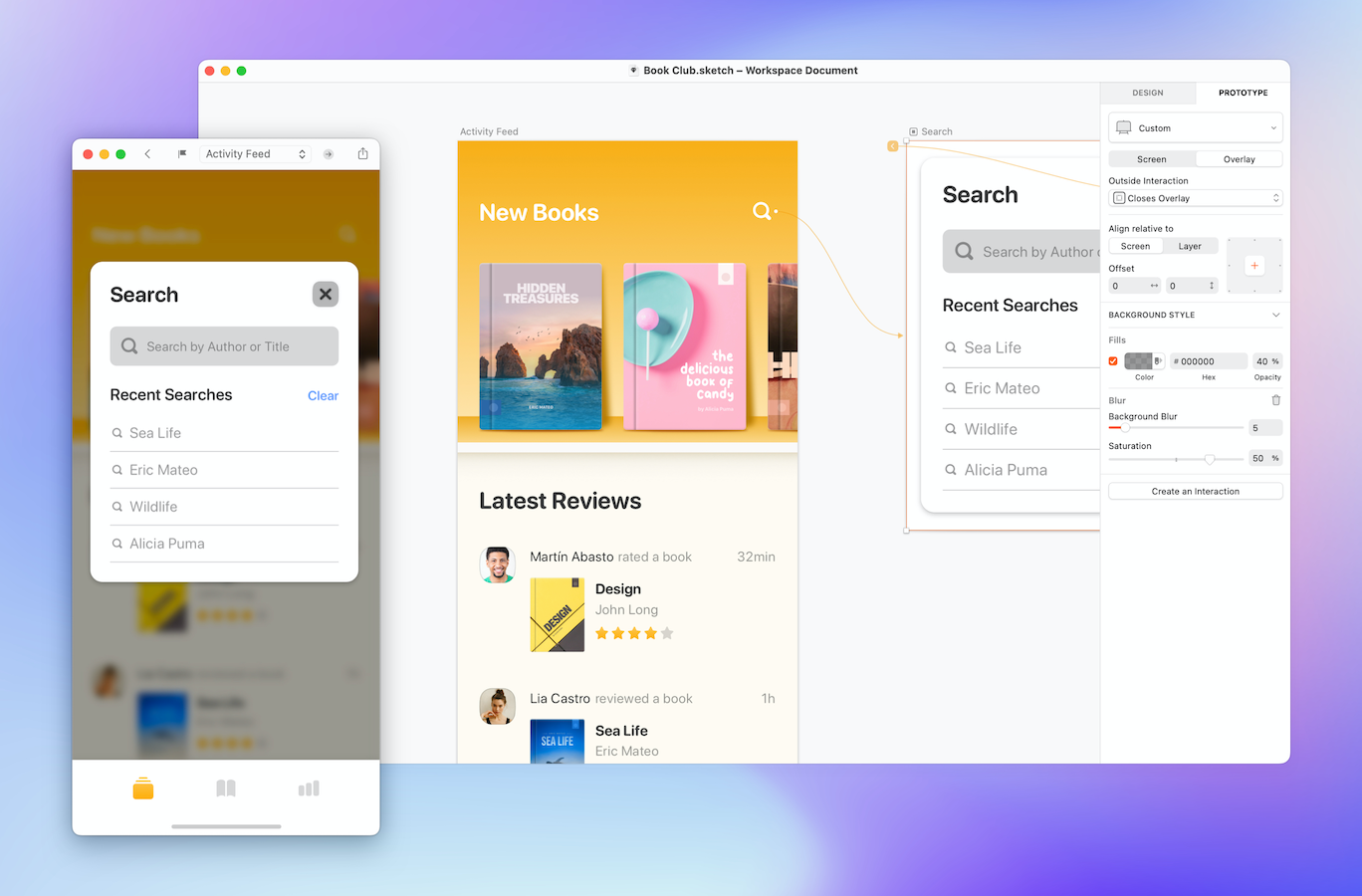

A Mac app for designers to create, team up, prototype, and more.

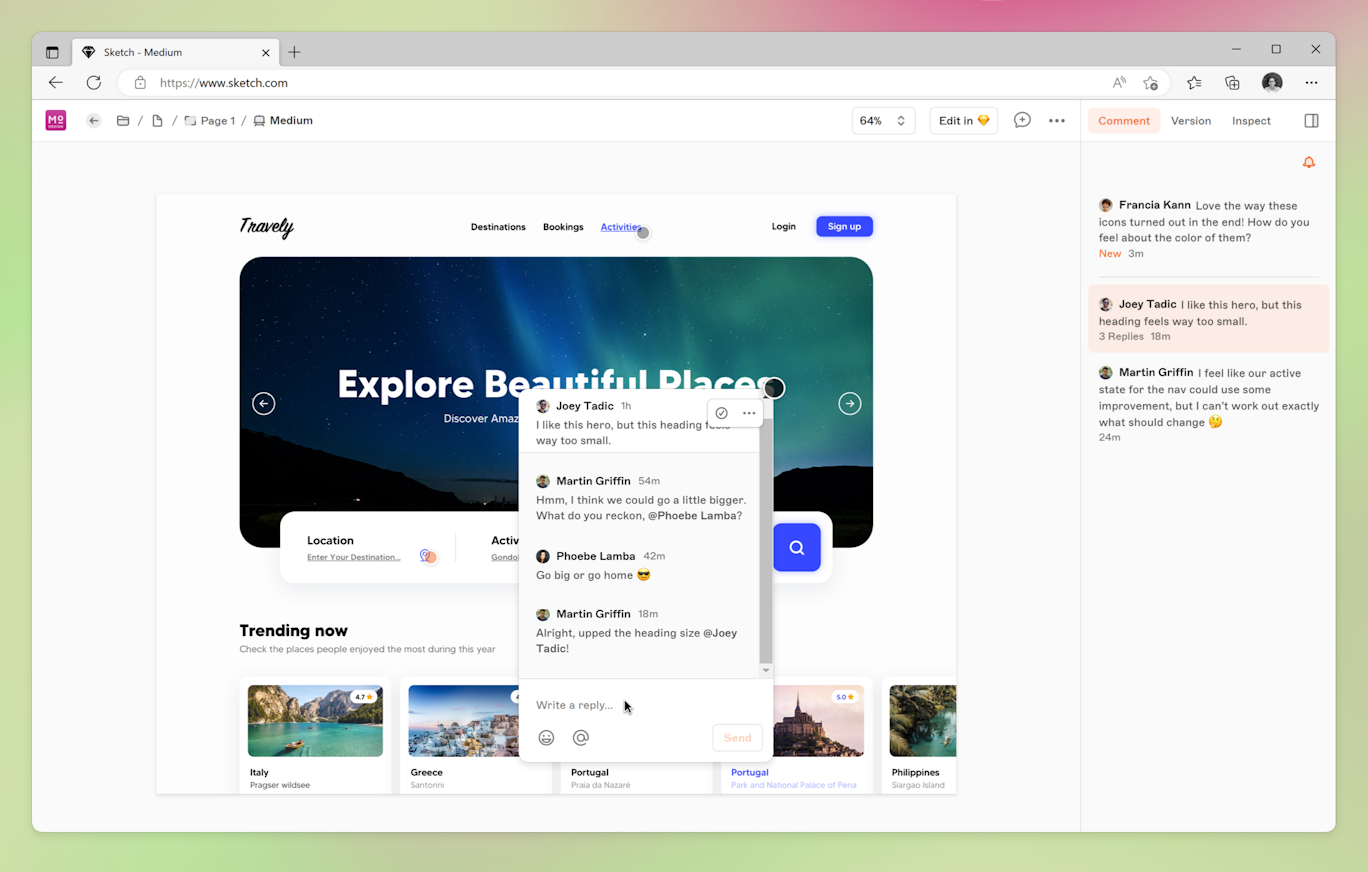

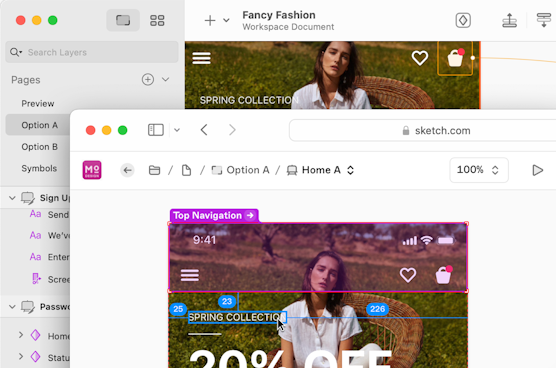

A web app for everyone else to browse, give feedback, inspect, and handoff — in any browser.

A complete design platform, made by a sustainable indie company since 2010.

Augusto

1m

Hit CtrlShift^H to see all of the custom homepages we made to celebrate some amazing designers!

Thank you for using Sketch, Yannick!

A Mac app you’ll love to design with

With thoughtful features that make mundane tasks easy, and an intuitive interface that won’t interrupt your flow, you’ll do amazing things with Sketch.

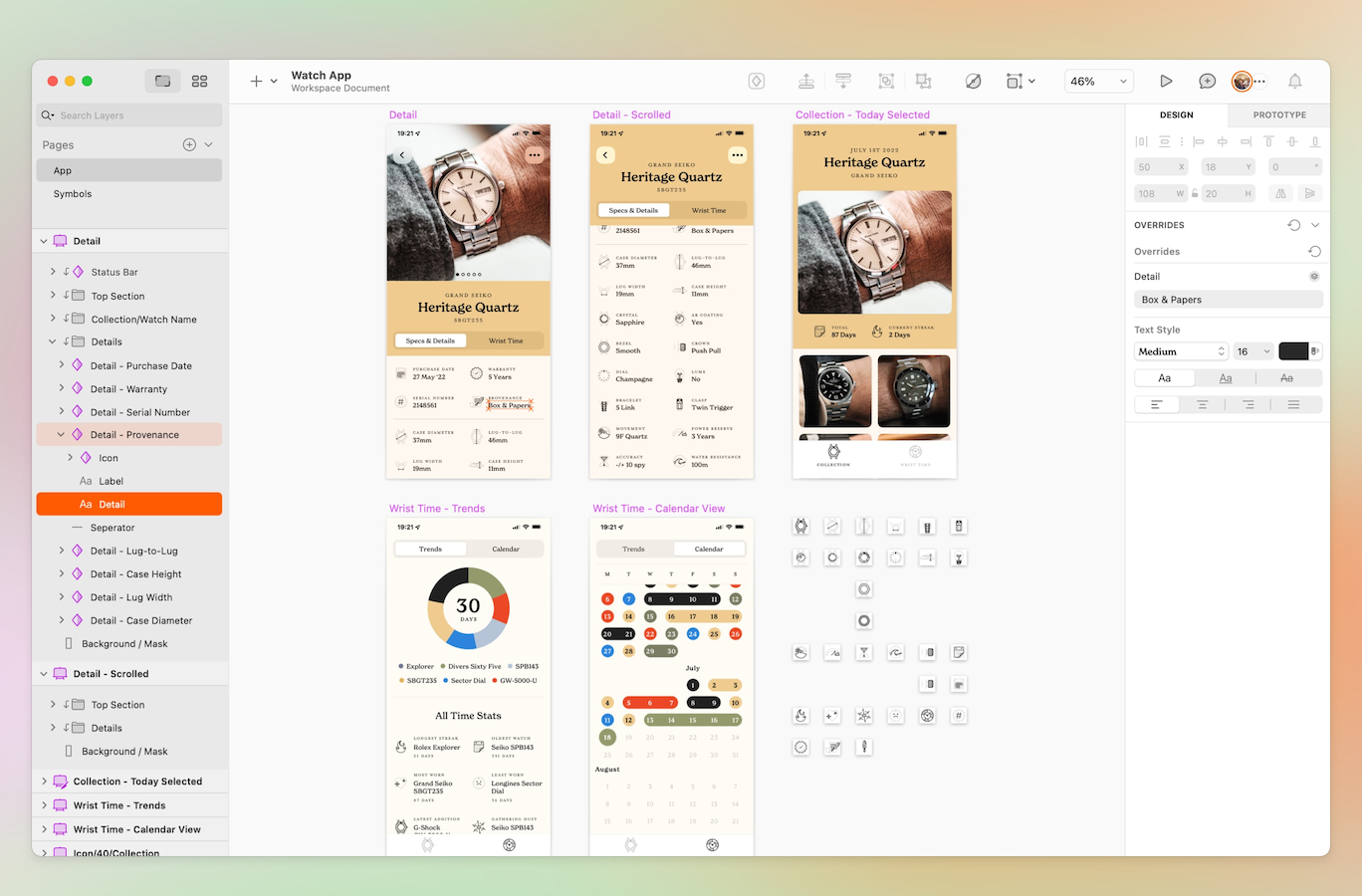

All the tools to help you create — from early wireframes, to flexible design systems

Control every point at the foundation of your designs.

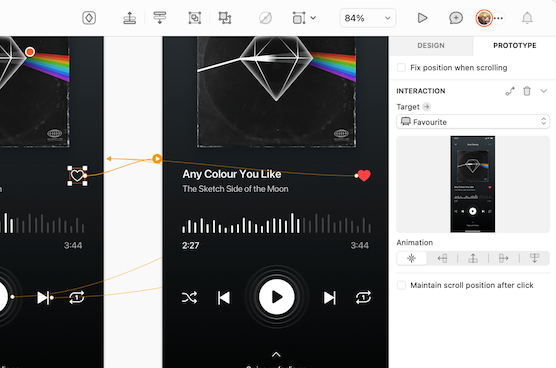

Turn your ideas into something that anyone can test.

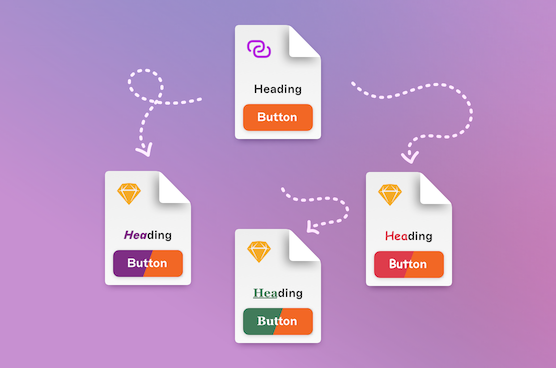

Bring consistency and scalability to your designs.

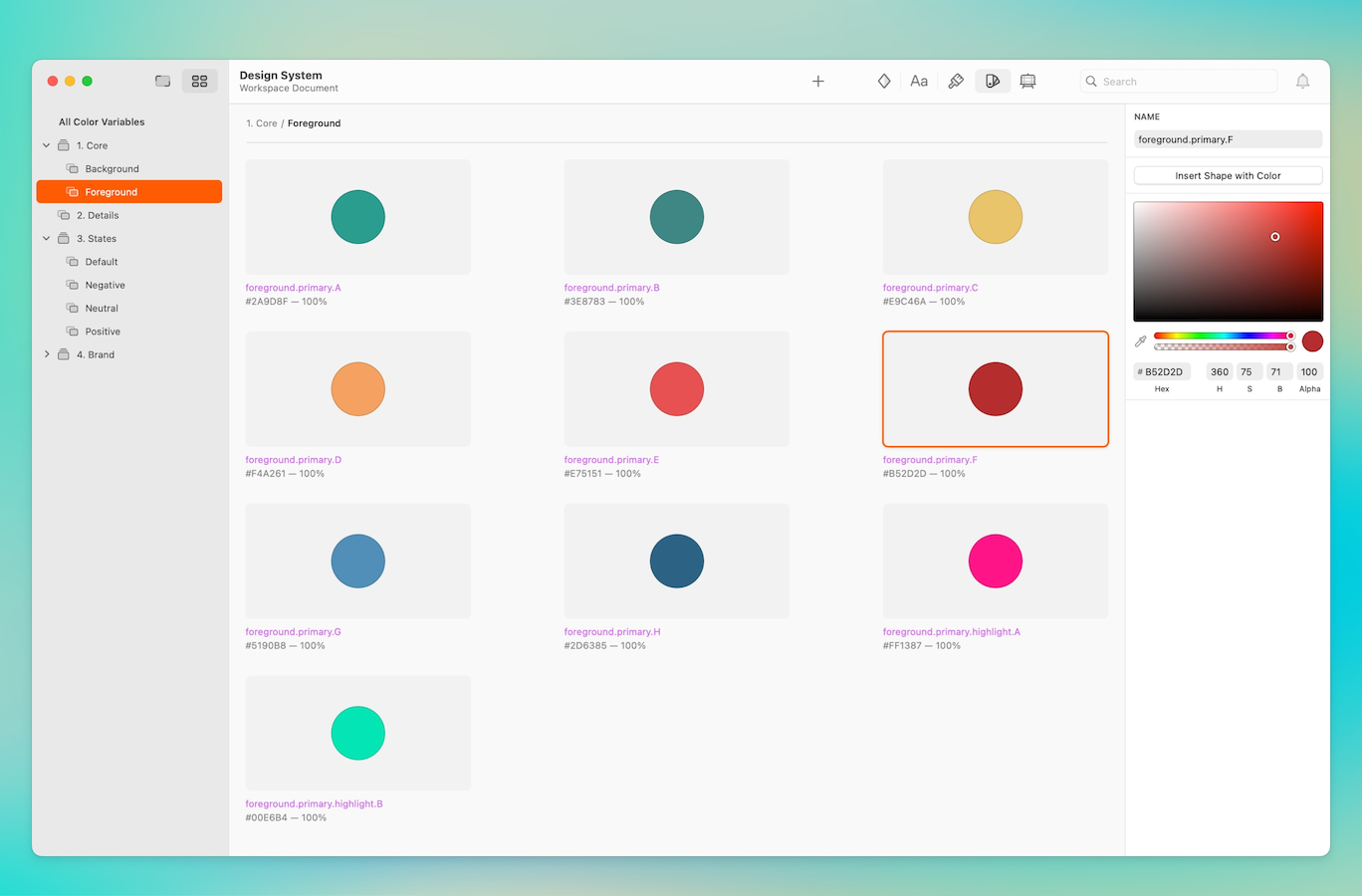

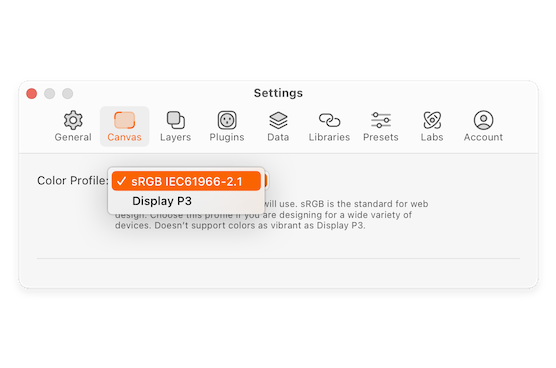

Choose between sRGB or P3, whenever you want.

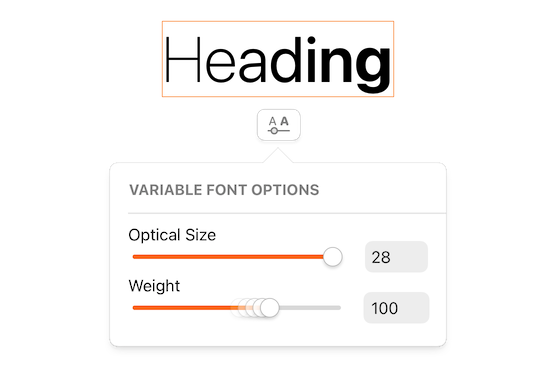

Work with the best of modern typography technology.

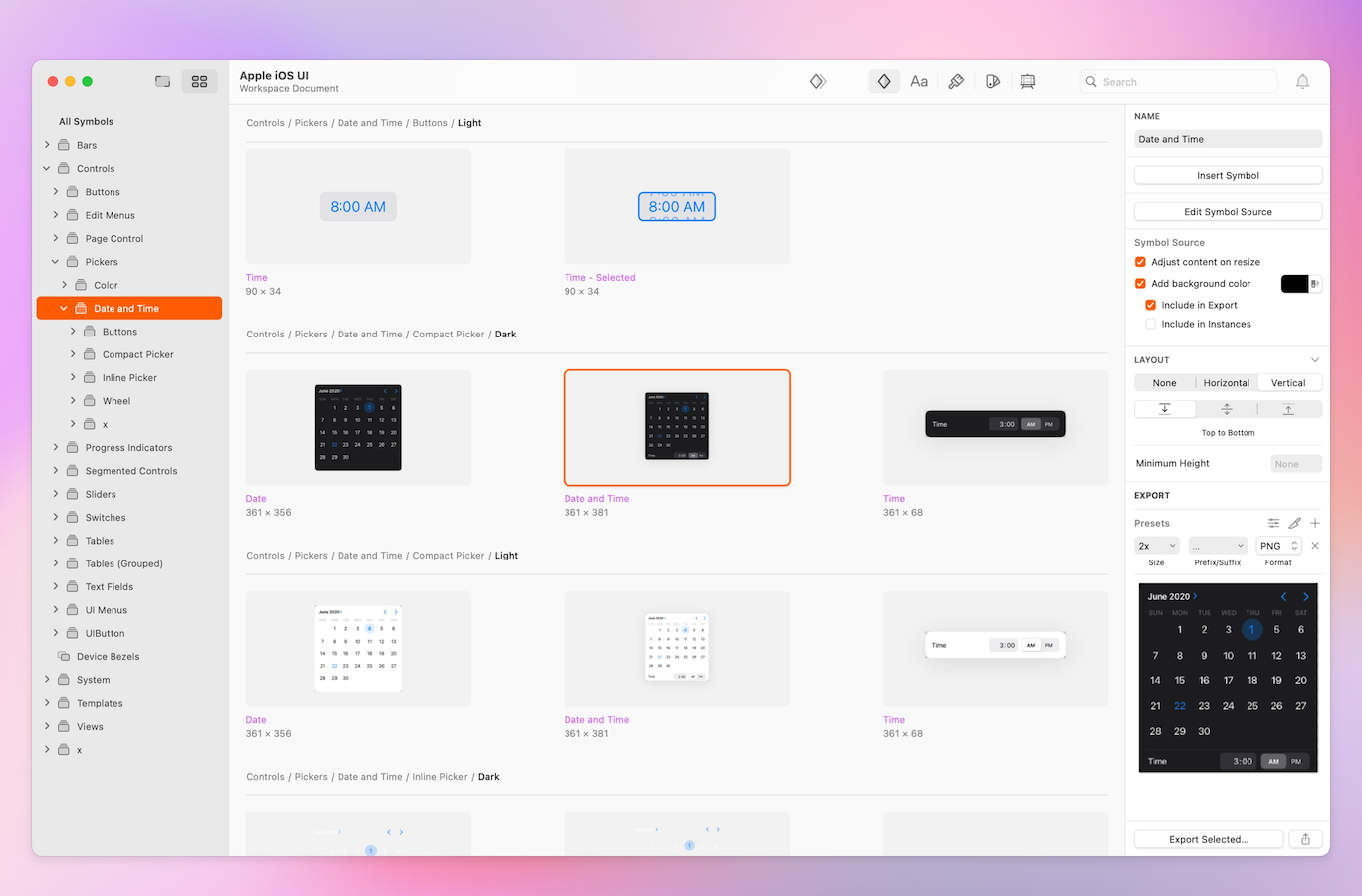

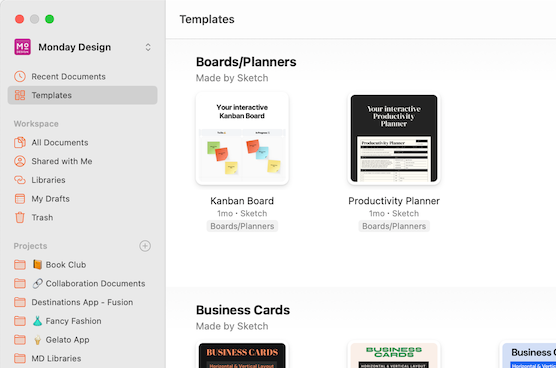

Get a head start with building blocks for every project.

Come on in, the water’s fine!

Workflows that adapt to you — whether you’re working solo, starting small, or scaling up

Work alone, or with others — it’s always up to you.

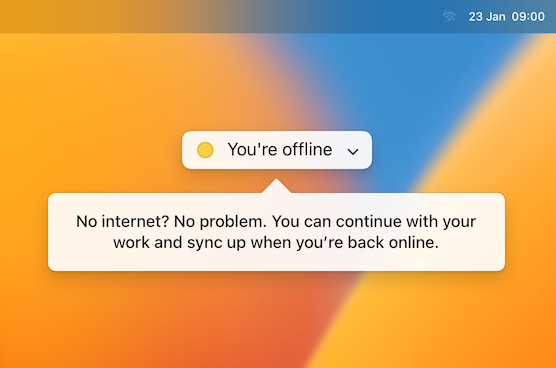

You don’t need an internet connection to create.

Access documents in your Workspace whever you sign in to Sketch.

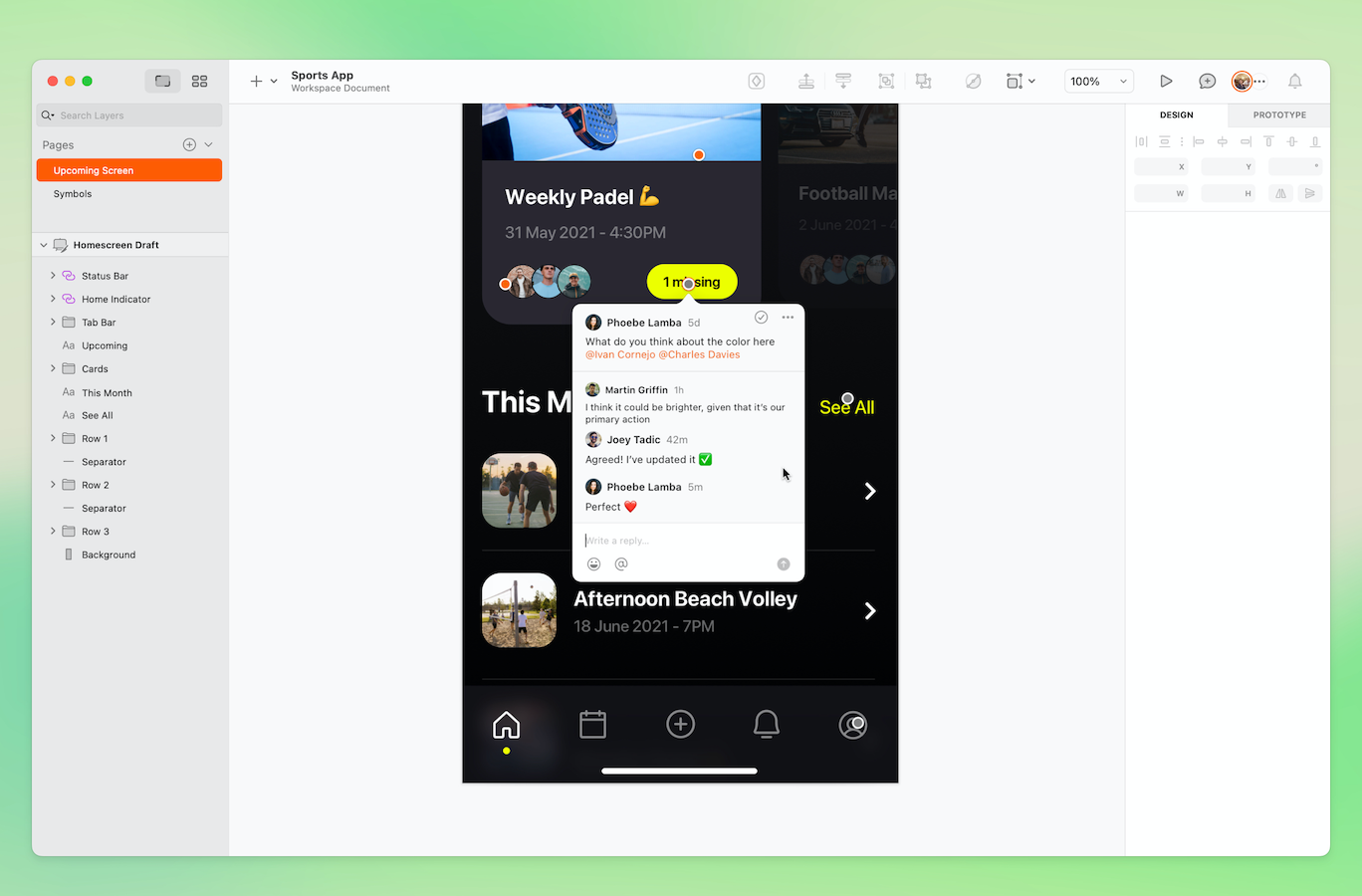

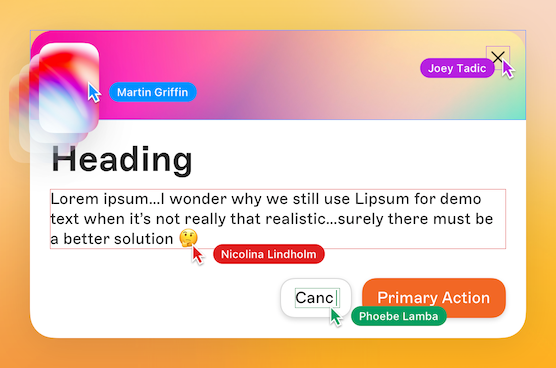

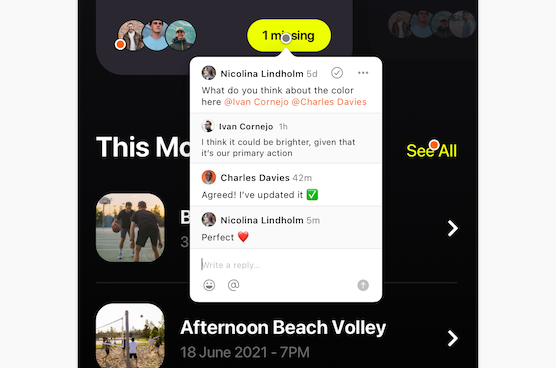

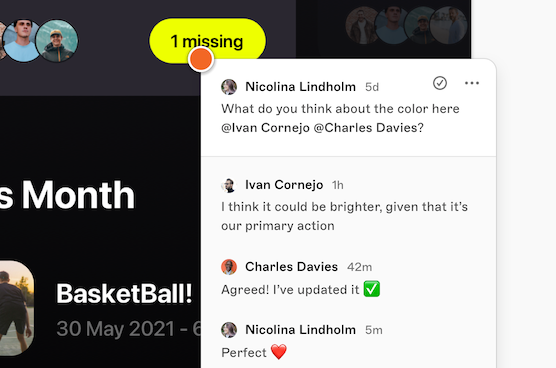

See and respond to comments without switching apps.

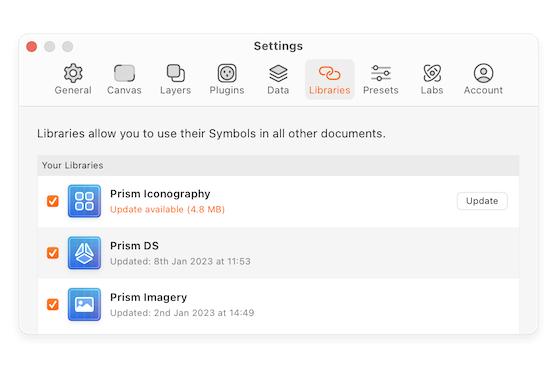

Easily share the building blocks of your product and brand.

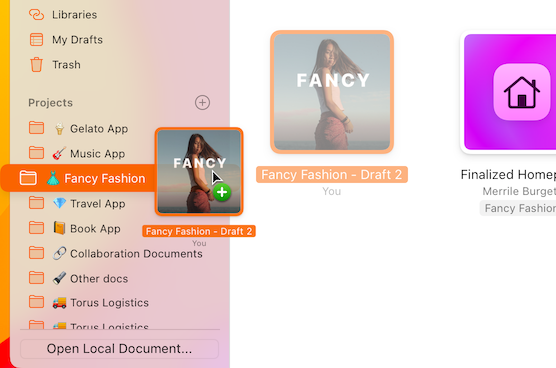

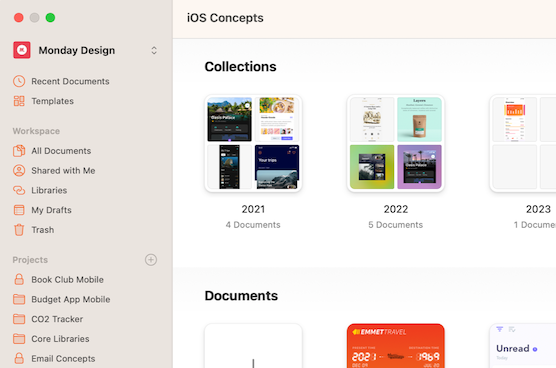

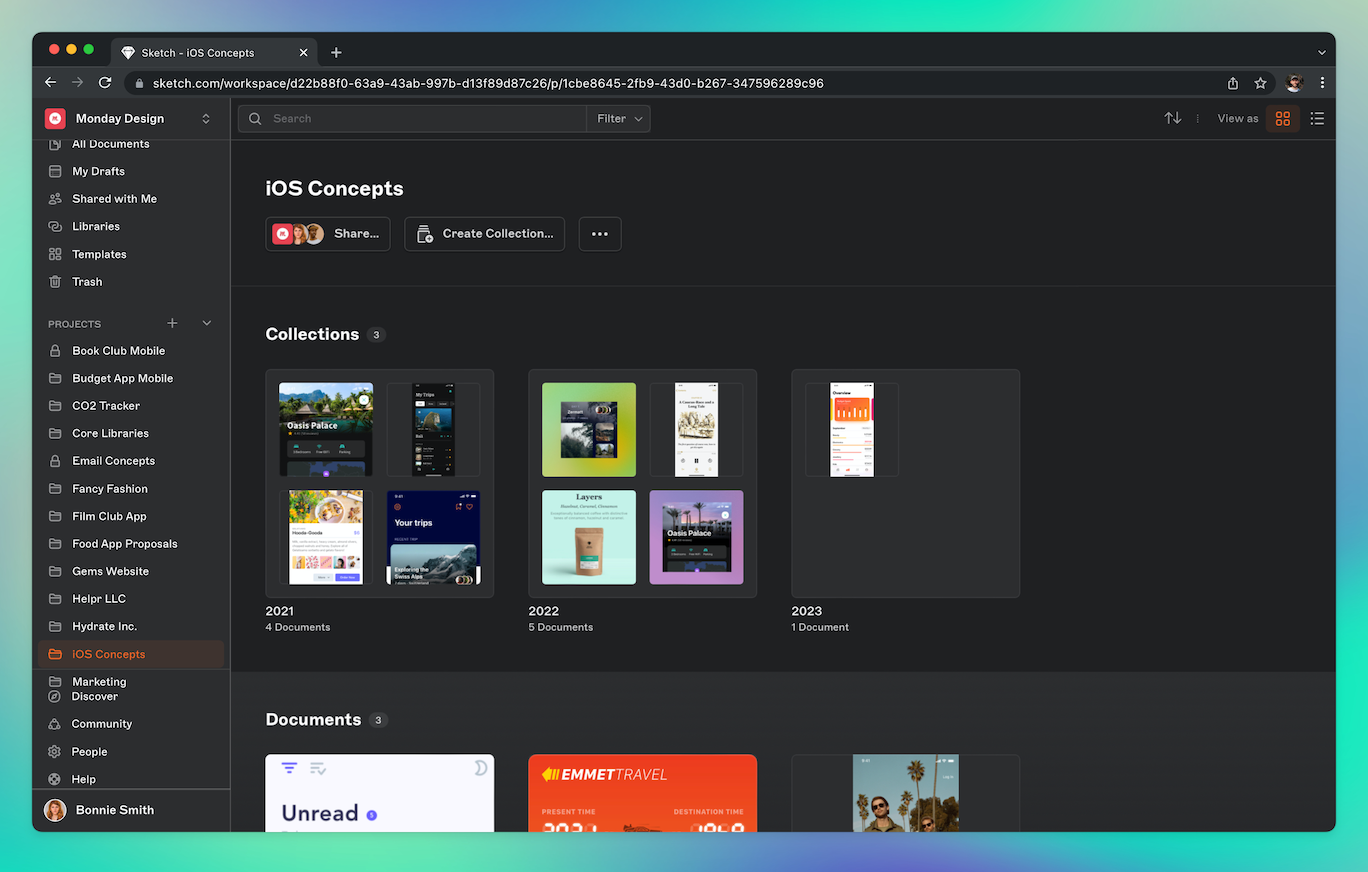

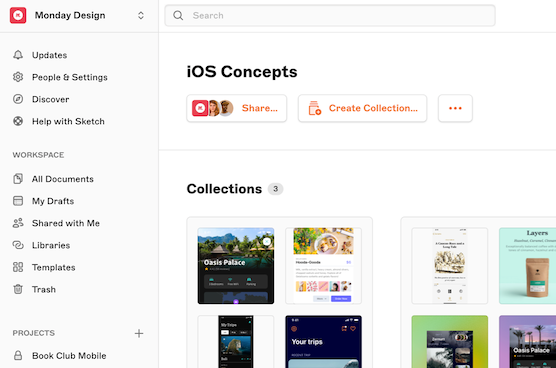

Organize with projects and collections, and keep ideas private in drafts.

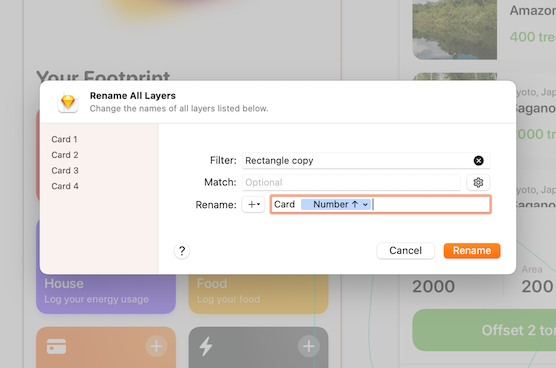

Now there’s no excuse not to join the “Name your layers” club.

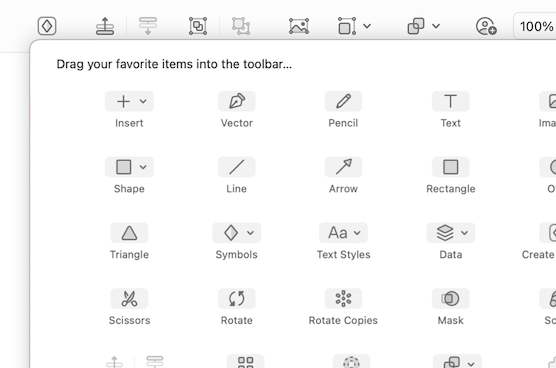

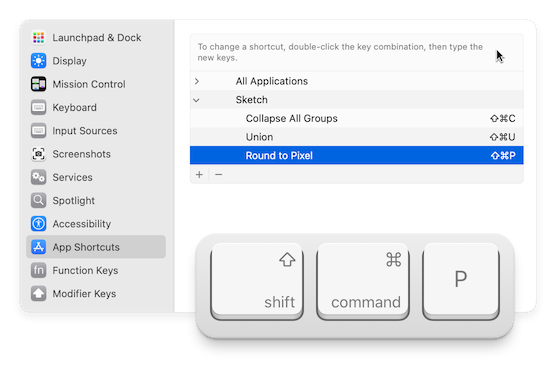

A powerful Native Mac app, that you can make your own

Maya

2d

Are we sure that people are definitely going to click these comments?

-

Eli

2d

Not sure, but hopefully! If not, they’ll miss out on some really riveting content

-

Maya

2d

Yeah, fair point. Their loss!

Sebastian

1w

Who made these icons? They are so great 🧑🍳💋

Martín

4d

So I’ve been thinking. When Thanos snapped half of all living things away, what about, like, the micro bacteria in people’s guts? Wouldn’t that mess with everyone’s digestion?

-

Malin

3d

Okay so first of all, this probably isn’t the place to discuss that. But also, it’s a comic book movie. Stop overthinking it.

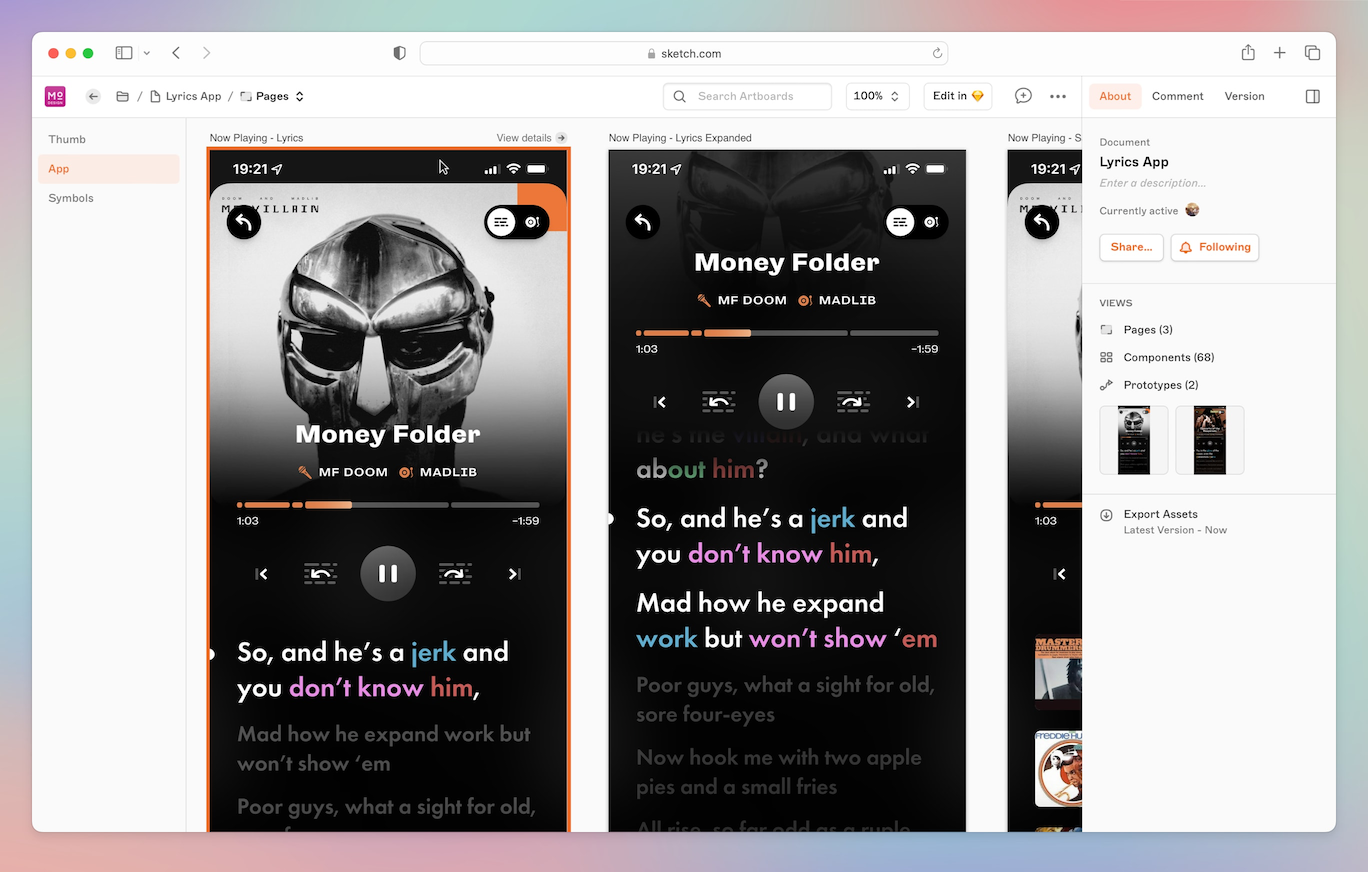

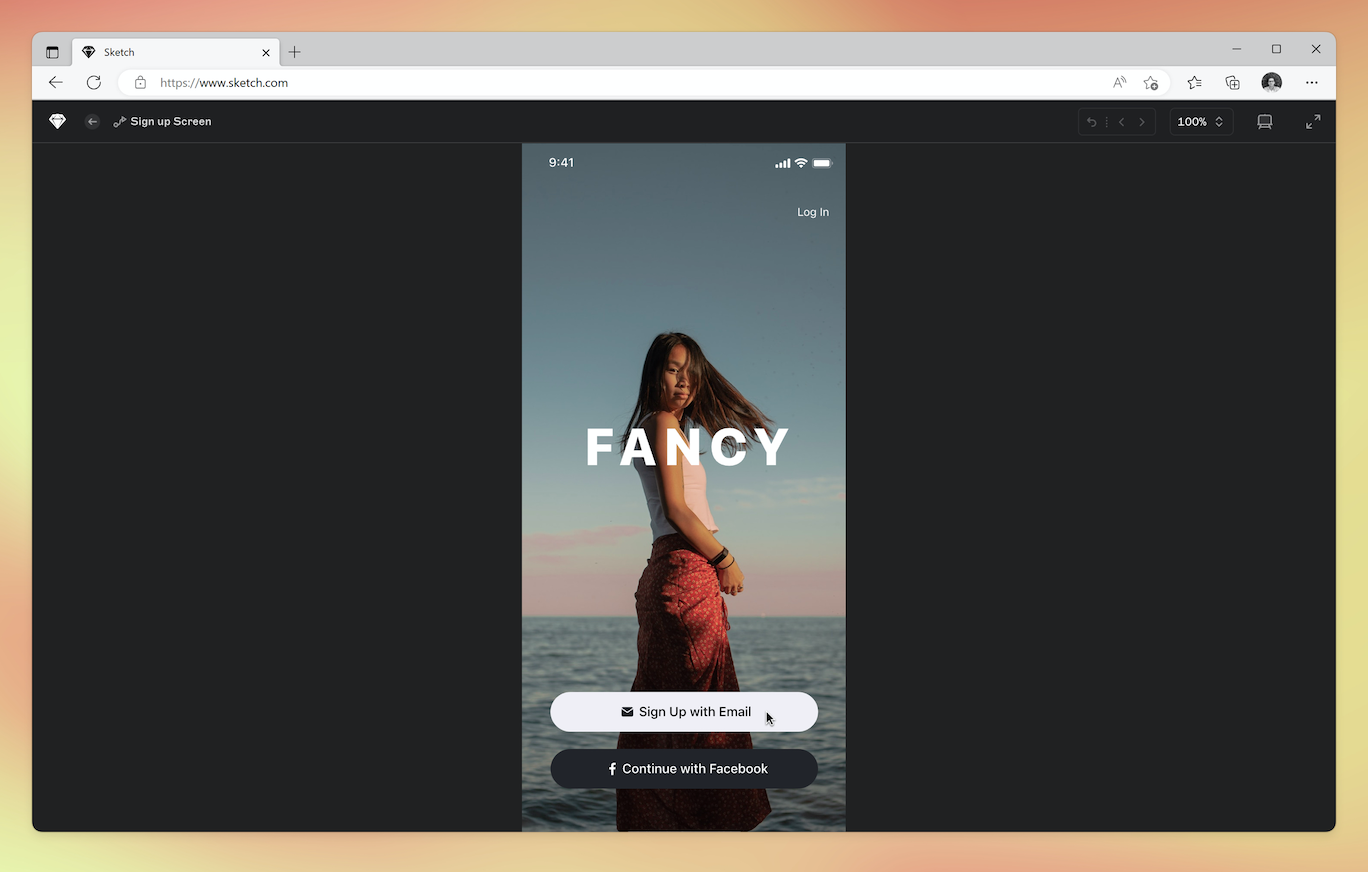

A web app for sharing, feedback and handoff

Bring people and projects together — in any web browser — to replace back-and-forth pings, email attachments and endless revisions.

Browser-based tools, ready for everyone to make the most of

Keep documents together, in sync, and track every milestone.

Create projects and collections to suit your workflows.

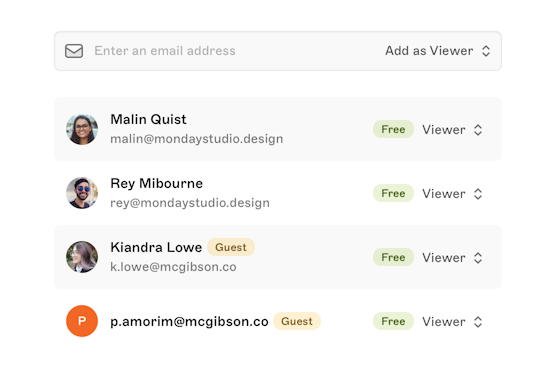

Invite clients, project managers and developers as free viewers.

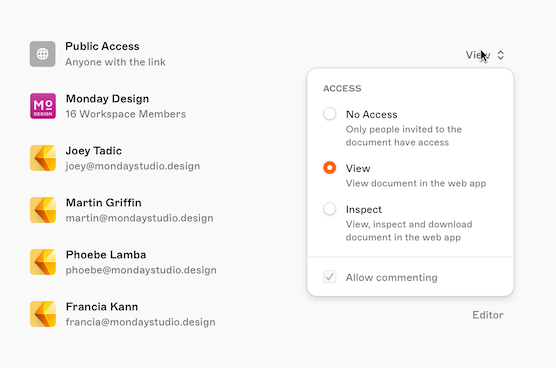

Get full control over who can see and edit designs.

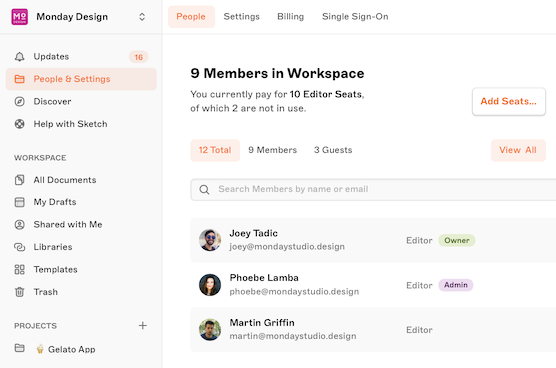

Manage people, files and billing — all in one place.

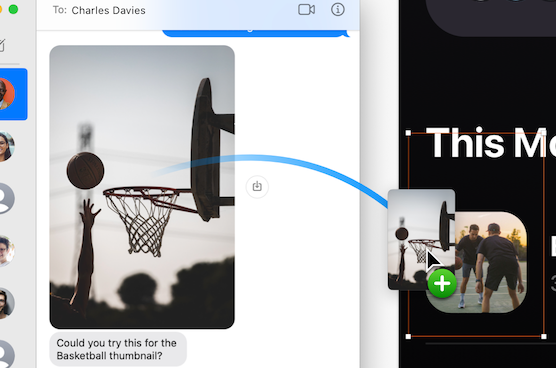

Invite collaborators to add comments right on the Canvas.

Give designers instant access to shared assets.

Share your ideas and show anyone how they will work.

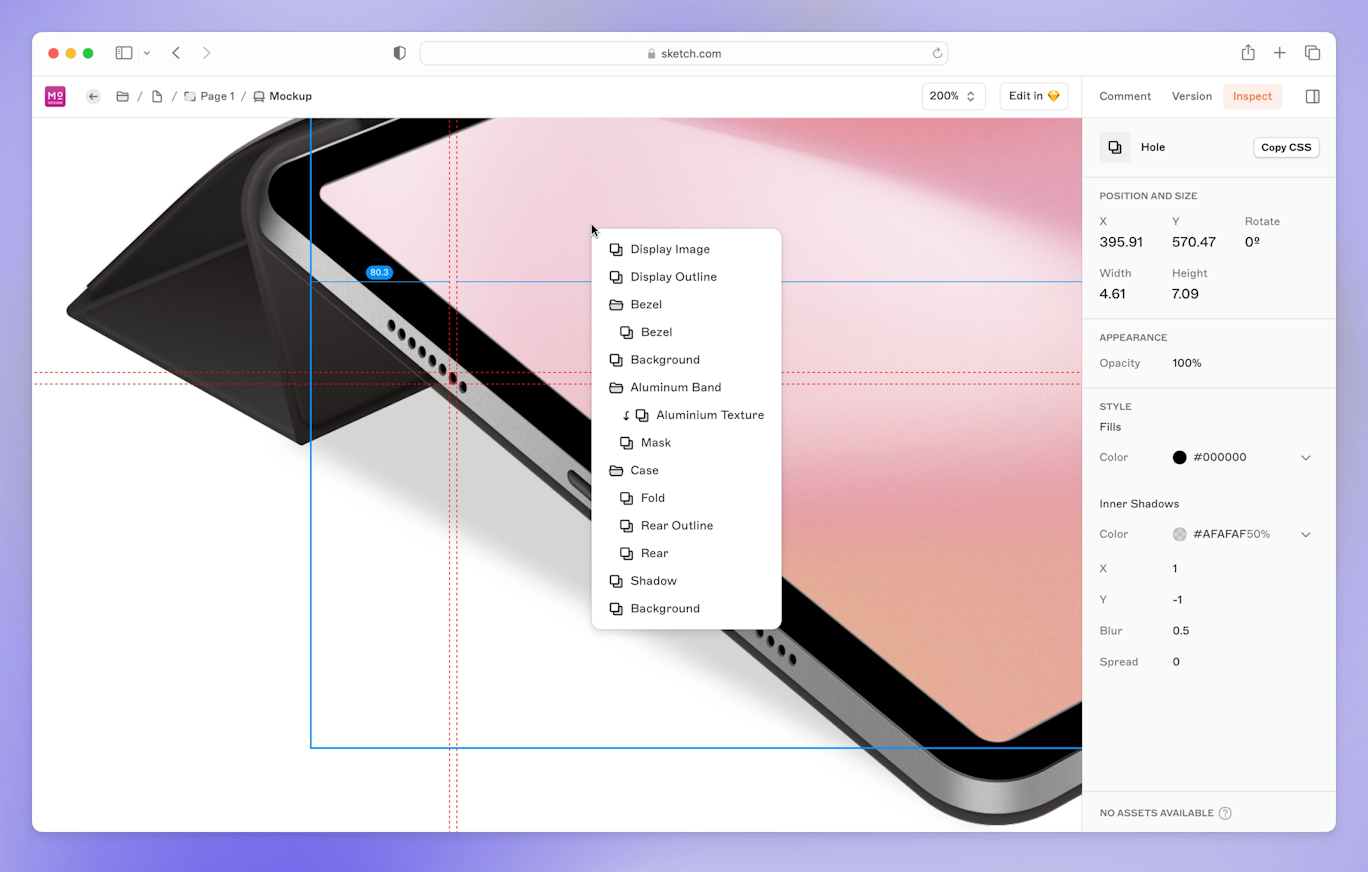

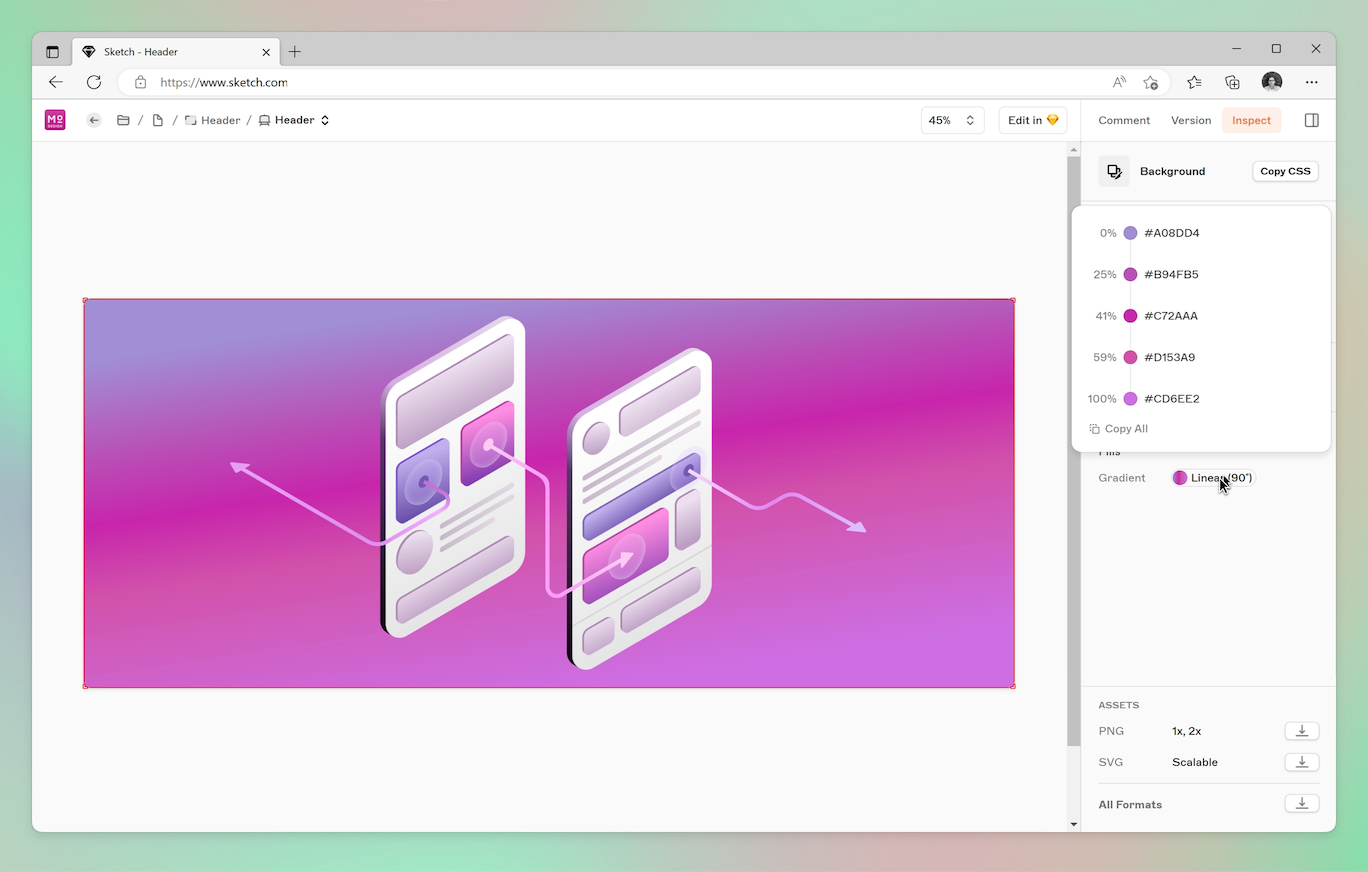

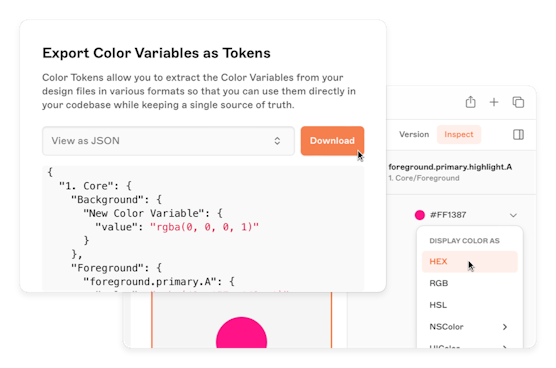

Inspect, grab assets and create Color Tokens.

No need to learn design tools — using our web app is easy as pie.

Invite everyone you need at no extra cost.

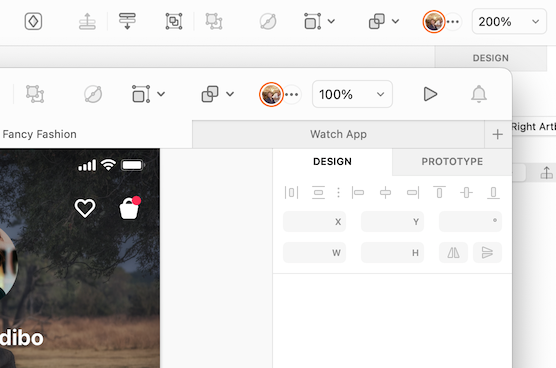

iPhone and iPad app for previewing

Browse your Workspace, view documents, mirror designs on your Mac, preview prototypes, and more — from anywhere.

New to design?

Starting with Sketch is easier than you think.

Resources

Kickstart your projects with our ready-made templates, or get up to speed with our self-paced courses. All for free!

Guides & Courses Free design templates Documentation

Get inspired

Go Beyond the Canvas and discover bite-sized design tutorials, inspiring stories and more on our blog.

Read our latest blog posts Customer stories Learn design

Start creating today for free!

Whether you’re new to Sketch or back to see what’s new, we’ll have you set up and ready to do your best work in minutes.